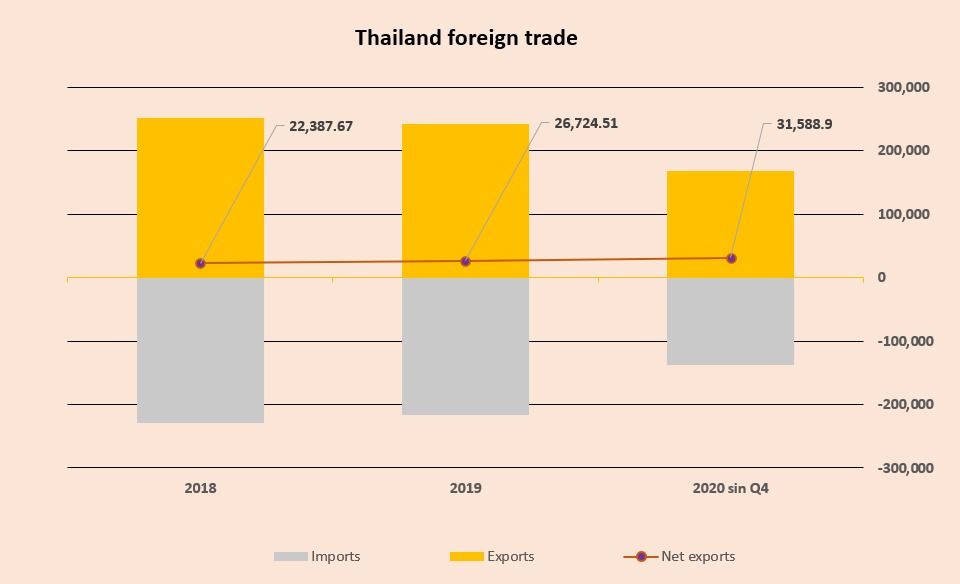

Like most Southeast Asian countries, Thailand enjoys a positive trade balance of $22.38 billion. Although the trend has been deteriorating recently due to the pandemic situation, the 12-month merchandise trade balance is recording a trade surplus. Economists from the banking sector in Thailand project that exports will grow by 5.5% in 2021 and imports by 7.9%, which would bring the trade surplus to USD 36.5 billion US. In 2022, exports and imports are expected to increase by 6.9% and 7.9%.

Source: Own elaboration

Thailand’s GDP for 2020, (US$ 513 billion) contracted by 5.5% compared to 2019, due to the heavy reliance on tourism and exports for the country’s economy.

How to import from Thailand

When deciding to purchase products from the Kingdom of Thailand for import into another country, it is necessary to execute the “Export Customs Clearance” process in Thailand, which can be processed by both the manufacturer and the buyer, although for the latter the work is more tedious due to the country’s internal regulations.

Filing of export declaration

In Thailand it is processed with a document called “Export Declaration (Kor Kor Kor. 101/1)”, which is a unique and exclusive format by the Thai Customs Department. This process must be executed before proceeding with the shipment of the goods to customs for export. When the customs system grants the validation, the payment of the duty (if any) and the subsequent transfer of the goods to customs for further inspection.

Information to be prepared for filing export declarations

Before submitting export declarations, the following documentation must be prepared:

- Account price list (proforma invoice)

- Packing list

- License or permit (In case of restricted goods or export controlled goods)

Format and form for the filing of the export declaration

The export declaration must be submitted in computer format and to the Customs Department in the following ways:

- Exporters submit the export declaration information to customs and register as a customs broker in order to complete the relevant customs formalities with the Customs Department.

- The exporter assigns the customs broker (Customs Broker) to submit the information.

- The exporter provides the Service Counter to send the information.

- Exporter submits the export declaration in the form of a document together with a detailed export declaration information form (key declaration) to the customs office of export.

Payment of duties and taxes

Once the exporter has submitted the entry into the Customs Department’s computer system and has received a response to the entry number, the exporter must complete the payment of duties (if any) and customs duties before proceeding to clearance.

Exporters can pay taxes and customs duties in the following 3 ways:

- Pay manually in all Customs Department payment units: both cash, tax cards, debit cards, credit cards and commercial checks with bank guarantee, and approved by the Customs Department.

- Pay in the electronic payment system along with the submission of the declaration information.

- Payment in the electronic bill payment system is the use of Customs Department documents (e.g., declaration, collection order) containing a QR code or barcode or reference number as shown on the document to pay at the bank counter or Internet banking, ATM or channel.

Sending the outgoing transfer invoice

When the exporter has finished loading the goods on the vehicle. The exporter must deliver the goods in accordance with the format and standard established by the Customs Department. After sending the invoice information in electronic format to the computer system of the Customs Department, if the system approved, the system will assign a number of the freight invoice.

When preparing such information, the exporter must provide the actual packing invoice of the goods for each transport vehicle. And use the invoice for the movement of goods or the number of such invoice as a goods account, (Form Sor.Bor. 3), to show to the customs officer at the border post before taking the vehicle through the land border out of the Kingdom of Thailand.

Goods movement invoice inspection and debiting

When the product is packed and the invoice is duly sent, the exporter must take the vehicle to the customs office where the cargo will be exported. Customs officials will verify the validity and charge the invoice for the movement. They will execute the inspection order according to the results of the risk analysis of the computer system as follows:

- In case of a “Green Line Exemption” order, the exporter may contact the customs officer to take the vehicle to the border post and cross the land border out of the Kingdom immediately.

- In case of an “Open (Red Line)” order, the exporter must contact the customs officer to inspect the cargo before taking the vehicle to the border.

* Annotation: In case of exporting a small quantity, for example, an item with a value of not more than 50,000 baht, it is not subject to duty.

Costs

All goods manufactured in Thailand for export purposes are exempt from VAT, and regardless of the factory purchase value of the Thai product, only the transportation of the goods and the export customs clearance process generate an additional cost:

- $175 usd per day per 40 ft container for inland transportation.

- $1,500 usd to Europe and $4,000 usd to Latin America per 40 ft container for ocean freight + insurance.

- $15-20 usd for customs clearance process costs.

Prohibited items for export from Thailand

- Narcotics

- Counterfeit real or official stamps

- Counterfeit brand name products

- Counterfeit currency, bonds or coins

- Products with inappropriate Thai flag design

- Obscene literature and pornographic material

- IPR infringing goods, e.g. music tape, CD, VDO, computer software, etc.

However, domestic regulations in Thailand are very tedious and for many processes, it is required to properly register with the government and incorporate a legal entity with at least 51% Thai representation.

From HISPASIAM we strongly recommend you to consult our service as international purchasing agent before starting your business, Thailand is not an easy country, and if any forwarder does not do his job professionally, your goods run the risk of getting lost.

Import from Thailand to Chile

Chile is becoming one of the fastest growing economies in Latin America in recent years, thanks to its great wealth of raw materials, being one of the leading countries in the production and export of mining products worldwide. In addition, the neoliberal economic model prevailing in this Andean country is attracting a lot of foreign investment to the country, which makes exporting from Thailand to Chile an attractive commercial solution for many Asian companies eager to penetrate the Latin American market. In the recently closed 2020 fiscal year, Chile ranked as the fifth Latin American country with the highest nominal GDP and GDP per capita of the 19 Latin American constituent countries, (International Monetary Fund)

Chile was the first Latin American country to establish trade relations with China, (1970), and today they have a very strong bilateral trade relationship, where exporting from China to Chile has become one of the cornerstones of the Chilean economic base. On the other hand, the United States represents Chile’s second most important trading partner, also through a bilateral treaty that in addition to reducing tariffs between the two countries, has served to reduce trade barriers for services: intellectual property and anti-competitive legislation among other measures.

Today Chile maintains numerous trade agreements with different countries and organizations worldwide:

- Trade Facilitation Agreement, (TFA), with the World Trade Organization in 2017.

- Free Trade Agreement (FTA) with the member countries of MERCOSUR in 1996.

- Free Trade Agreement with North America in 2004.

- Free trade agreement with Canada in 1997 and updated in 2019.

- Free trade agreement with Mexico in 1999.

- Trade agreements with Latin American and Pacific countries in 1997 and in 2017 with Panama.

- Free trade agreement with Mexico in 1999.

- Free trade agreement with South America in 2009 and in 2019.

- Free trade agreement with Australia in 2015.

- Pacific alliance treaty in 2018.

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP / TIPAT) in 2018.

- Free trade agreement with the European Union (EU) in 2003.

- Free trade deal with the United Kingdom in 2019.

- Free trade deal with China in 2006.

- Free trade deal with Thailand in 2015.

Why importing from Thailand to Chile is a wise decision?

The Chilean political system is stable, democratic but not very dominant in the economy, which together with the prevailing liberal model of sustaining free trade in Chile, makes this country an ideal place to invest and to start commercial relations with Latin America.

On the other hand, most of Chile’s international trade is in goods, due to the fact that the country’s main productive sectors are mining and agriculture, which makes it a very attractive country in the eyes of exporting countries whose comparative advantage is that of industrial and finished consumer products. In addition, since the entry into force in 2015 of the bilateral free trade agreement with Thailand, more than 90% of the tariff lines of products are exempted from import tax.

Import from Thailand to Mexico

Mexico’s economy is among the 15 largest economies in the world and is the second largest economy in all of Latin America with a population of nearly 130 million. Since the beginning of the 21st century, Mexico has experienced slow economic growth, generating only an average of 2% per year, a circumstance that has generated a converging trend in relation to the economies of other high-income countries.

Along with China, the Central American country has been and is one of the main commercial partners of the United States: thanks to weak fiscal policies, cheap labor and a strategic geographic positioning. In recent years, U.S. policy decisions to deport immigrants from Central American countries, cut trade relations and increase tariffs on imports to Mexico have created distrust and disinterest in continuing to forge trade commitments with the Americans.

Even so, the investments coming from North America during this century, leave a legacy of automotive industry in the Mexican country of a great magnitude, and taking into account also, the North American trade agreement (T-MEC), which was improved last 2018, and by which the United States, Canada and Mexico enjoy 0% import tariffs for American free trade, suggests that Mexico remains an essential partner for the North American economy.

But the Mexican economy sees with good eyes to create trade relations with developing Asian countries, with which to generate economic growth more in line with the potential of the country that Mexico has, because being the least economically advantaged country in the North American agreement is slowing its economic development, which is why importing from Thailand to Mexico is a feasible alternative and a wise decision for any company.

Mexico’s star products

Last 2020, Mexico stood out in its exports for doing so in agricultural products: (avocado, meat, crustaceans, mango, grapes and soybeans mainly), and industrial products: cars, construction materials. parts for engines and vehicles, poly carboxylic acids and anhydrides, petroleum, intermediate products of iron or steel, parts for typewriters, computers and their parts …).

On the import side, in this 2020, Mexico has imported mainly Gasoline (10.24%), Automobiles (9.42%), Digital monolithic integrated circuits (8.94%), and non-digital (6.84%), Parts or spare parts for transmitter/receiver devices (6.77%), Plastic manufactures (4.91%)…, and in short many other novel technological products, as well as electronic components and different novel manufactures of metals and plastics mainly.

Advantages of importing from Thailand to Mexico

Mexico’s economy is a free, export-oriented economy, currently has free trade agreements (FTA) with more than 40 countries around the world, and specifically is a participant in the Treaty of Progressive Integration of Trans-Pacific Partnership (TIPAT) and the Asia-Pacific Economic Cooperation Forum (APEC), in addition to active economic partnership programs with Japan since 2005, and with China since 2004, as well as other economic programs for the even economic growth with Korea, India and Malaysia.

Undoubtedly, the strong dependence of Mexico with the United States slows and hinders the Mexican economic growth, since the Central American country has greater growth potential than the North American, and Mexico is open to foreign trade to try to capture new trading partners to provide new alternatives and new products with which to develop, which is why a country like Thailand, in the process of development would find in Mexican companies and customers a great support and optimal business partners with which to grow economically and without limitations.

Import from Thailand to Spain

Since 1986, the country of Spain officially belongs to the European Union, and is a member of the Eurozone since 1999. From the European Union is centralized all the economy of the registered countries, (a total of 27 countries), which at the time of carrying out foreign trade relations, such as imports, share the same tariff rate for all products imported from outside the European Union.

Before carrying out any commercial project to import from Thailand to Spain any product, it is necessary to review the regulations applied by the European Union in this aspect, which also affect Spain, for example, to those related to trade defense measures such as antidumping, anti subsidies or safeguards, when the EU industry is injured by dumped or subsidized imports.

Facts and realities on imports

Since 1995, imports in EU exports have increased by more than half, to 13%.

The import rates of the EU, (among which are those belonging to Spain), are among the lowest in the world. The foreign trade policy that is defended is to enable in the market those developing countries, being the commercial territory that imports more products from less developed countries in the world, even more than the U.S., Japan, Canada, and China together. More than 65% of EU imports are raw materials, intermediate goods, and components needed for the production processes of European companies.

Imports from Spain

The main countries from which Spain imports are 58% from European Union countries, 3% from the United States and 7% from China. But if we make a small analysis of imports from Asian countries to Spain, between 1995 and the present, they have increased from 8,000 to more than 20,000 million euros.

The main products imported by Spain are petroleum, petroleum gases and their derivatives, automobiles and their parts or spare parts, medicines, electric telephony or telegraphy devices, electronic accessories and textile products, mainly from Asian countries such as China, Bangladesh and India.

Among the products to be imported from Thailand to Spain, those which are in high demand within the Spanish market are: chemical products, metal derivatives, machinery, electrical equipment, consumer goods, vehicles and their components, food, animals, vegetable products, and minerals.

Imports of Asian products to Spain are mainly from China, with approximately 7%, but also come from countries such as India, Vietnam, Myanmar, Indonesia, Pakistan and Thailand.

Advantages of importing from Thailand to Spain

Bearing in mind the foreign trade policy of the European Union, to favor the import of products from developing countries, the commercial stability present in the EU, the evident experience that currently exists between Spain and Thailand in trade relations, the process of revaluation that China is undergoing in recent years, and the growing demand for products by Spain indicates that countries like Thailand are ideal business partners profiles to carry out commercial business with Spain.

The Covid-19 pandemic has frozen to a high degree the trade flow between countries, but in a stable socioeconomic situation, Thailand undoubtedly has a clear advantage to become a major trading partner to import products within the Spanish territory.